United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the :

For the transition period from _______________

Commission File No. |

Name of Registrant, State of Incorporation, Address of Principal Executive Offices, and Telephone No. |

IRS Employer Identification No. |

(a ( |

||

(a ( |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of Class |

Trading Symbol |

Name of Each Exchange on which Registered |

MGE Energy, Inc. |

The |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

|

Title of Class |

Madison Gas and Electric Company |

Common Stock, $1 Par Value Per Share |

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

MGE Energy, Inc.

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

MGE Energy, Inc. Yes ☐

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days.

MGE Energy, Inc.

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit such files):

MGE Energy, Inc.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

Accelerated Filer |

Smaller Reporting Company |

Emerging Growth Company |

||

MGE Energy, Inc. |

☒ |

☐ |

☐ |

||

Madison Gas and Electric Company |

☐ |

☐ |

☒ |

If an emerging growth company, indicate by checkmark if the registrants have elected not to use the extended transition period for complying with any new or revised financial reporting standards provided pursuant to Section 13(a) of the Exchange Act.

MGE Energy, Inc. ☐ Madison Gas and Electric Company ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

MGE Energy, Inc.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

MGE Energy, Inc. Yes ☐ No

The aggregate market value of the voting and nonvoting common equity held by nonaffiliates of each registrant as of June 30, 2021 was as follows:

$ |

|

|

$ |

The number of shares outstanding of each registrant's common stock as of January 31, 2022, were as follows:

MGE Energy, Inc. |

|

Madison Gas and Electric Company |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of MGE Energy, Inc.'s definitive proxy statement to be filed before April 30, 2022, relating to its annual meeting of shareholders, are incorporated by reference into Part III of this annual report on Form 10-K.

Madison Gas and Electric Company meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore omitting (i.) the information otherwise required by Item 601 of Regulation S-K relating to a list of subsidiaries of the registrant as permitted by General Instruction (I)(2)(b), (ii.) the information otherwise required by Item 10 relating to Directors and Executive Officers as permitted by General Instruction (I)(2)(c), (iii.) the information otherwise required by Item 11 relating to Executive Compensation as permitted by General Instruction (I)(2)(c), (iv.) the information otherwise required by Item 12 relating to Security Ownership of Certain Beneficial Owners and Management as permitted by General Instruction (I)(2)(c), and (v.) the information otherwise required by Item 13 relating to Certain Relationships and Related Transactions as permitted by General Instruction (I)(2)(c).

Table of Contents

3

Filing Format

This combined Form 10-K is being filed separately by MGE Energy, Inc. (MGE Energy) and Madison Gas and Electric Company (MGE). MGE is a wholly owned subsidiary of MGE Energy and represents a majority of its assets, liabilities, revenues, expenses, and operations. Thus, all information contained in this report relates to, and is filed by, MGE Energy. Information that is specifically identified in this report as relating solely to MGE Energy, such as its financial statements and information relating to its nonregulated business, does not relate to, and is not filed by, MGE. MGE makes no representation as to that information. The terms "we" and "our," as used in this report, refer to MGE Energy and its consolidated subsidiaries, unless otherwise indicated.

Forward-Looking Statements

This report, and other documents filed by MGE Energy and MGE with the Securities and Exchange Commission (SEC) from time to time, contain forward-looking statements that reflect management's current assumptions and estimates regarding future performance and economic conditions—especially as they relate to economic conditions, future load growth, revenues, expenses, capital expenditures, financial resources, regulatory matters, and the scope and expense associated with future environmental regulation. These forward-looking statements are made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. Words such as "believe," "expect," "anticipate," "estimate," "could," "should," "intend," "will," and other similar words, and words relating to goals, targets and projections, generally identify forward-looking statements. Both MGE Energy and MGE caution investors that these forward-looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those projected, expressed, or implied.

The factors that could cause actual results to differ materially from the forward-looking statements made by a registrant include (a) those factors discussed in Item 1A. Risk Factors, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and Item 8. Financial Statements and Supplementary Data, Footnote 16. Commitments and Contingencies, and (b) other factors discussed herein and in other filings made by that registrant with the SEC.

Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this report. MGE Energy and MGE undertake no obligation to release publicly any revision to these forward-looking statements to reflect events or circumstances after the date of this report, except as required by law.

Where to Find More Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and other information with the SEC. The SEC maintains an internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

MGE Energy maintains a website at mgeenergy.com, and MGE maintains a website at mge.com. Copies of the reports and other information that we file with the SEC may be obtained from our websites free of charge. Information contained on MGE Energy's and MGE's websites shall not be deemed incorporated into, or to be a part of, this report.

4

Definitions, Abbreviations, and Acronyms Used in the Text and Notes of this Report

Abbreviations, acronyms, and definitions used in the text and notes of this report are defined below.

MGE Energy and Subsidiaries: |

|

|

|

|

|

CWDC |

|

Central Wisconsin Development Corporation |

MAGAEL |

|

MAGAEL, LLC |

MGE |

|

Madison Gas and Electric Company |

MGE Energy |

|

MGE Energy, Inc. |

MGE Power |

|

MGE Power, LLC |

MGE Power Elm Road |

|

MGE Power Elm Road, LLC |

MGE Power West Campus |

|

MGE Power West Campus, LLC |

MGE Services |

|

MGE Services, LLC |

MGE State Energy Services |

|

MGE State Energy Services, LLC |

MGE Transco |

|

MGE Transco Investment, LLC |

MGEE Transco |

|

MGEE Transco, LLC |

North Mendota |

|

North Mendota Energy & Technology Park, LLC |

|

|

|

Other Defined Terms: |

|

|

|

|

|

2006 Plan |

|

MGE Energy's 2006 Performance Unit Plan |

2013 Plan |

|

MGE Energy's 2013 Director Incentive Plan |

2017 Tax Act |

|

Tax Cuts and Jobs Act of 2017 |

2020 Plan |

|

MGE Energy's 2020 Performance Unit Plan |

2021 Incentive Plan |

|

MGE Energy's 2021 Long-Term Incentive Plan |

ACE |

|

Affordable Clean Energy |

AFUDC |

|

Allowance for Funds Used During Construction |

ANR |

|

ANR Pipeline |

ARO |

|

Asset Retirement Obligation |

ATC |

|

American Transmission Company LLC |

ATC Holdco |

|

ATC Holdco, LLC |

Badger Hollow I |

|

Badger Hollow I Solar Farm |

Badger Hollow II |

|

Badger Hollow II Solar Farm |

BART |

|

Best Available Retrofit Technology |

Blount |

|

Blount Station |

BTA |

|

Best Technology Available |

CA |

|

Certificate of Authority |

CAA |

|

Clean Air Act |

CAVR |

|

Clean Air Visibility Rule |

CCR |

|

Coal Combustion Residual |

CO2 |

|

Carbon Dioxide |

codification |

|

Financial Accounting Standards Board Accounting Standards Codification |

Columbia |

|

Columbia Energy Center |

Cooling degree days |

|

Measure of the extent to which the average daily temperature is above 65 degrees Fahrenheit, which is considered an indicator of possible increased demand for energy to provide cooling |

COVID-19 |

|

Coronavirus Disease 2019 and its variants |

COSO |

|

Committee of Sponsoring Organizations |

CPP |

|

Clean Power Plan |

CSAPR |

|

Cross-State Air Pollution Rule |

CWA |

|

Clean Water Act |

D.C. Circuit |

|

United States Court of Appeals for the District of Columbia Circuit |

Dth |

|

Dekatherms |

EEI |

|

Edison Electric Institute |

electric margin |

|

Electric revenues less fuel for electric generation and purchase power costs, a non-GAAP measure |

ELG |

|

Effluent Limitations Guidelines |

Elm Road Units |

|

Elm Road Generating Station |

EPA |

|

United States Environmental Protection Agency |

FASB |

|

Financial Accounting Standards Board |

FERC |

|

Federal Energy Regulatory Commission |

Forward Wind |

|

Forward Wind Energy Center |

5

FTR |

|

Financial Transmission Rights |

GAAP |

|

Generally Accepted Accounting Principles |

gas margin |

|

Gas revenues less cost of gas sold, a non-GAAP measure |

GHG |

|

Greenhouse Gas |

heating degree days (HDD) |

|

Measure of the extent to which the average daily temperature is below 65 degrees Fahrenheit, which is considered an indicator of possible increased demand for energy to provide heating |

ICF |

|

Insurance Continuance Fund |

IPCC |

|

Intergovernmental Panel on Climate Change |

IRS |

|

Internal Revenue Service |

kVA |

|

Kilovolt Ampere |

KW |

|

Kilowatt, a measure of electric energy generating capacity |

kWh |

|

Kilowatt-hour |

MISO |

|

Midcontinent Independent System Operator, Inc. (a regional transmission organization) |

MW |

|

Megawatt |

MWh |

|

Megawatt-hour |

NAAQS |

|

National Ambient Air Quality Standards |

Nasdaq |

|

The Nasdaq Stock Market |

NERC |

|

North American Electric Reliability Corporation |

NNG |

|

Northern Natural Gas Company |

NOV |

|

Notice of Violation |

NOx |

|

Nitrogen Oxides |

NYSE |

|

New York Stock Exchange |

O'Brien |

|

O'Brien Solar Fields |

OSCE |

|

State of Wisconsin's Office of Sustainability and Clean Energy |

Paris Agreement |

|

Paris Agreement under the United Nations Framework Convention on Climate Change |

PCBs |

|

Polychlorinated Biphenyls |

the Petition |

|

Petition for Judicial Review of Agency Action |

PGA |

|

Purchased Gas Adjustment clause |

PM |

|

Particulate Matter |

PPA |

|

Purchased power agreement |

PSCW |

|

Public Service Commission of Wisconsin |

REC |

|

Renewable Energy Credit |

RER |

|

Renewable Energy Rider |

Riverside |

|

Riverside Energy Center in Beloit, Wisconsin |

ROE |

|

Return on Equity |

RTO |

|

Regional Transmission Organization |

Saratoga |

|

Saratoga Wind Farm |

SCR |

|

Selective Catalytic Reduction |

SEC |

|

Securities and Exchange Commission |

SIP |

|

State Implementation Plan |

SO2 |

|

Sulfur Dioxide |

the State |

|

State of Wisconsin |

Stock Plan |

|

Direct Stock Purchase and Dividend Reinvestment Plan of MGE Energy |

Two Creeks |

|

Two Creeks Solar Farm |

UW |

|

University of Wisconsin at Madison |

VIE |

|

Variable Interest Entity |

WCCF |

|

West Campus Cogeneration Facility |

WDNR |

|

Wisconsin Department of Natural Resources |

WEPCO |

|

Wisconsin Electric Power Company |

working capital |

|

Current assets less current liabilities |

WPDES |

|

Wisconsin Pollutant Discharge Elimination System |

WPL |

|

Wisconsin Power and Light Company |

WPSC |

|

Wisconsin Public Service Corporation |

WRERA |

|

Worker, Retiree and Employer Recovery Act of 2008 |

XBRL |

|

eXtensible Business Reporting Language |

6

PART I.

Item 1. Business.

MGE Energy operates in the following business segments:

MGE's utility operations represent a majority of the assets, liabilities, revenues, expenses, and operations of MGE Energy. MGE Energy's nonregulated energy operations currently include an undivided interest in two coal-fired generating units located in Oak Creek, Wisconsin, which we refer to as the Elm Road Units, and an undivided interest in a cogeneration facility located on the Madison campus of the University of Wisconsin, which we refer to as the West Campus Cogeneration Facility or WCCF.

As a public utility, MGE is subject to regulation by the PSCW and the FERC. The PSCW has authority to regulate most aspects of MGE's business including rates, accounts, issuance of securities, and plant siting. The PSCW also has authority over certain aspects of MGE Energy as a holding company of a public utility. FERC has jurisdiction, under the Federal Power Act, over certain accounting practices and certain other aspects of MGE's business.

MGE Energy's subsidiaries are also subject to regulation under local, state, and federal laws regarding air and water quality and solid waste disposal. See "Environmental" below.

MGE Energy was organized as a Wisconsin corporation in 2001. MGE was organized as a Wisconsin corporation in 1896. Our principal offices are located at 133 South Blair Street, Madison, Wisconsin 53788, and our telephone number is (608) 252-7000.

With the global outbreak of the Coronavirus Disease 2019 (COVID-19) and the declaration of a pandemic by the World Health Organization on March 11, 2020, U.S. governmental authorities have deemed electric and gas utilities to be critical infrastructure. MGE Energy therefore has an obligation to keep operating and maintaining our critical electric and gas infrastructure. Since then, MGE Energy has been subject to, and is following, local, state and federal public health and safety regulations and guidance to control the pandemic. MGE Energy has operated continuously throughout the pandemic and has suffered no material disruptions in service or employment. See "Management's Discussion and Analysis of Financial Condition and Results of Operations - COVID 19 Update."

Electric Utility Operations

MGE distributes electricity in a service area covering a 264 square-mile area of Dane County, Wisconsin. The service area includes the city of Madison, Wisconsin. It owns or leases ownership interests in electric generation facilities located in Wisconsin and Iowa.

As of December 31, 2021, MGE supplied electric service to approximately 159,000 customers, with approximately 90% located in the cities of Fitchburg, Madison, Middleton, and Monona and 10% in adjacent areas.

7

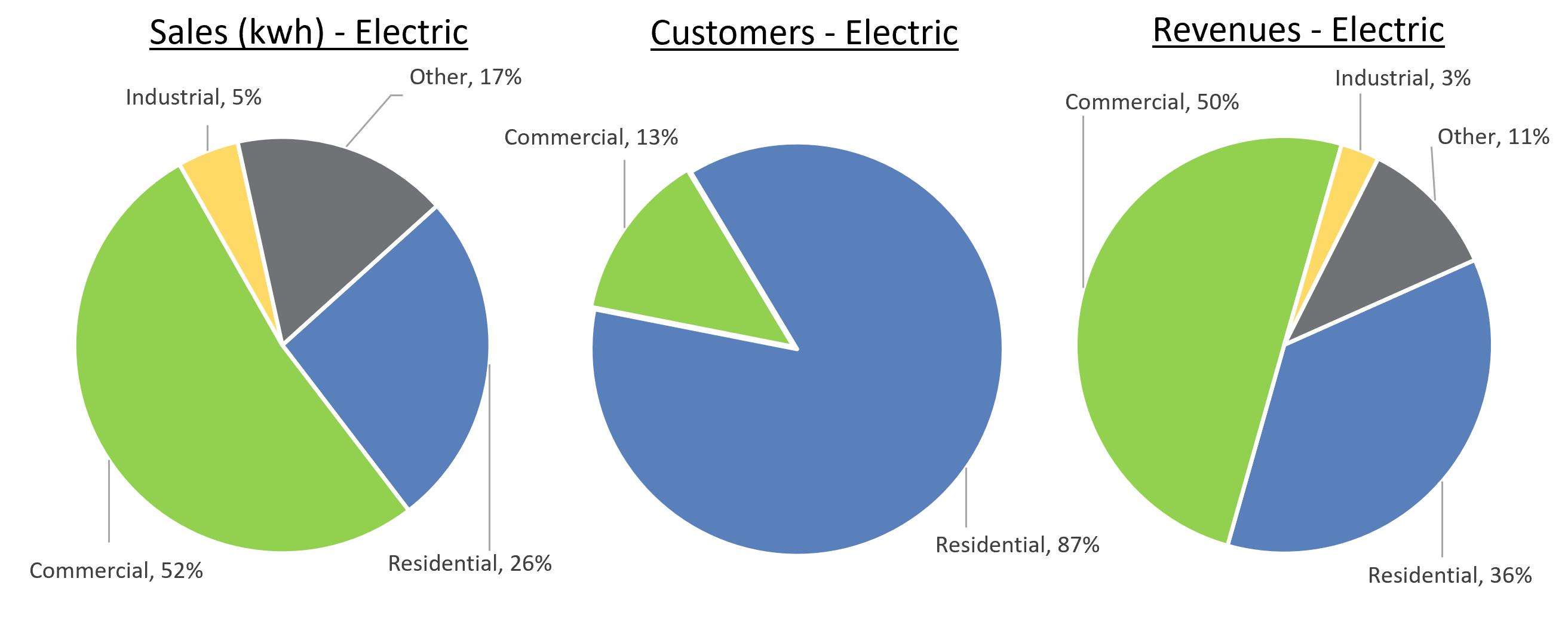

Electric sales, customers, and revenues for 2021 were comprised of the following:

Electric operations accounted for approximately 69.4%, 73.2%, and 71.9% of MGE's total 2021, 2020, and 2019 regulated revenues, respectively.

See Item 2. Properties for a description of MGE's electric utility plant.

MGE is registered with North American Electric Reliability Corporation (NERC) and one regional entity, the Midwest Reliability Organization. The essential purposes of these entities are to develop and implement regional and NERC reliability standards and determine compliance with those standards, including enforcement mechanisms.

Transmission

American Transmission Company LLC (ATC) was formed by Wisconsin-based utilities who were required by Wisconsin law to contribute their transmission facilities to it in 2001 and is owned by those utilities and their affiliates. ATC's purpose is to provide reliable, economic transmission service to all customers in a fair and equitable manner. ATC plans, constructs, operates, maintains, and expands transmission facilities that it owns to provide adequate and reliable transmission of power. ATC is regulated by FERC for all rate terms and conditions of service. ATC is also regulated by the PSCW for some aspects of its governance and is a transmission-owning member of the MISO.

Regional Transmission Organizations (RTO)

MISO

MGE is a nontransmission owning member of the MISO. MISO, a FERC-approved RTO, is responsible for monitoring the electric transmission system that delivers power from generating plants to wholesale power transmitters. MISO's role is to ensure equal access to the transmission system and to maintain or improve electric system reliability across 15 U.S. states and the Canadian province of Manitoba.

MISO maintains a bid-based energy market. MGE offers substantially all of its generation on the MISO market and purchases much of its load requirement from the MISO market in accordance with the MISO Tariff. MGE participates in the ancillary services market operated by MISO. That market is an extension of the existing energy market in which MISO assumes the responsibility of maintaining sufficient generation reserves. In the ancillary services market, MISO provides the reserves for MGE's load, and MGE may offer to sell reserves from its generating units.

MGE participates in the voluntary capacity auction, which provides an optional monthly forum for buyers and sellers of aggregate planning resource credits to interact. Load serving entities such as MGE may participate in the voluntary capacity auction potentially to obtain the necessary aggregate planning resource credits needed to meet

8

their planning reserve margin requirement established by the PSCW. Generator owners may participate to sell any excess aggregate planning resource credits.

Fuel supply and generation

MGE satisfies its customers' electric demand with internal generation and purchased power. MGE's current fuel mix for generation fluctuates from year-to-year due to fuel pricing in the market, generating unit availability, weather, and customer demand. MGE has a responsibility to its customers to dispatch the lowest cost generation available pursuant to regulatory requirements.

During 2021, MGE's electric energy delivery requirements were satisfied from the following fuel sources:

(in MWh) |

|

2021 |

|

|

2020 |

|

|

2019 |

|

|||

Coal |

|

|

1,797,017 |

|

|

|

1,566,204 |

|

|

|

1,751,224 |

|

Natural gas |

|

|

405,696 |

|

|

|

502,387 |

|

|

|

501,093 |

|

Renewable sources(a) |

|

|

581,374 |

|

|

|

485,965 |

|

|

|

470,716 |

|

Fuel oil |

|

|

884 |

|

|

|

472 |

|

|

|

695 |

|

Purchased power - other(b)(c) |

|

|

726,008 |

|

|

|

789,058 |

|

|

|

762,894 |

|

Total fuel sources |

|

|

3,510,979 |

|

|

|

3,344,086 |

|

|

|

3,486,622 |

|

|

|

|

|

|

|

|

|

|

|

|||

Adjusted total fuel sources(c) |

|

|

3,743,743 |

|

|

|

3,663,569 |

|

|

|

3,807,652 |

|

In May 2019, MGE announced the goal of net-zero carbon electricity by 2050. This goal followed the previous carbon reduction goals, set in 2015 in our Energy 2030 framework, which targeted a 40% carbon reduction by 2030 from 2005 levels. In January 2022, MGE announced a new target of 80% carbon reduction by 2030, significantly exceeding the original 2030 goal. MGE's carbon reduction goals are aligned with those of the scientific community, specifically the Intergovernmental Panel on Climate Change (IPCC) and its recommendation of limiting global temperature increases to 1.5 degrees Celsius above pre-industrial levels. In 2020, the University of Wisconsin-Madison's Nelson Institute for Environmental Studies released its analysis of MGE's goal of reaching net-zero carbon electricity by 2050. The IPCC modeling available suggested that by 2050, emissions from electricity generation in industrialized countries should be 87% to 99% lower than the 2005 baseline. The study determined that our 2050 goal is in line with model benchmarks to limit global warming to 1.5 degrees Celsius above pre-industrial levels.

MGE's future path to achieve its new target of 80% carbon reduction by 2030 is based on the transition away from coal and the addition of new renewable generation to reach our ultimate target of net-zero carbon by 2050.

Transition away from coal - In February 2021, MGE and the other co-owners of Columbia, a two-unit coal-fired generation facility located near Portage, Wisconsin, announced plans to retire that facility. MGE currently owns 19% of the facility. The co-owners intend to retire Unit 1 by the end of 2023 and Unit 2 by the end of 2024. Final timing and retirement dates are subject to change depending on operational, regulatory, and other factors. MGE is a minority owner of the coal-fired Elm Road Generating Station in Oak Creek, Wisconsin. In late 2021, MGE announced plans to transition the units from coal to natural gas as its primary fuel source. By 2025, with the planned retirement of both units at Columbia, MGE will have eliminated approximately two-thirds of the company’s current coal-fired generation capacity. MGE's remaining use of coal is expected to be further reduced as the Elm Road Units transition to natural gas. This transition will help MGE meet its 2030 carbon reduction goal. By 2035, MGE expects that the Elm Road Units will be fully transitioned away from coal, which will eliminate coal as an owned generation source for MGE.

9

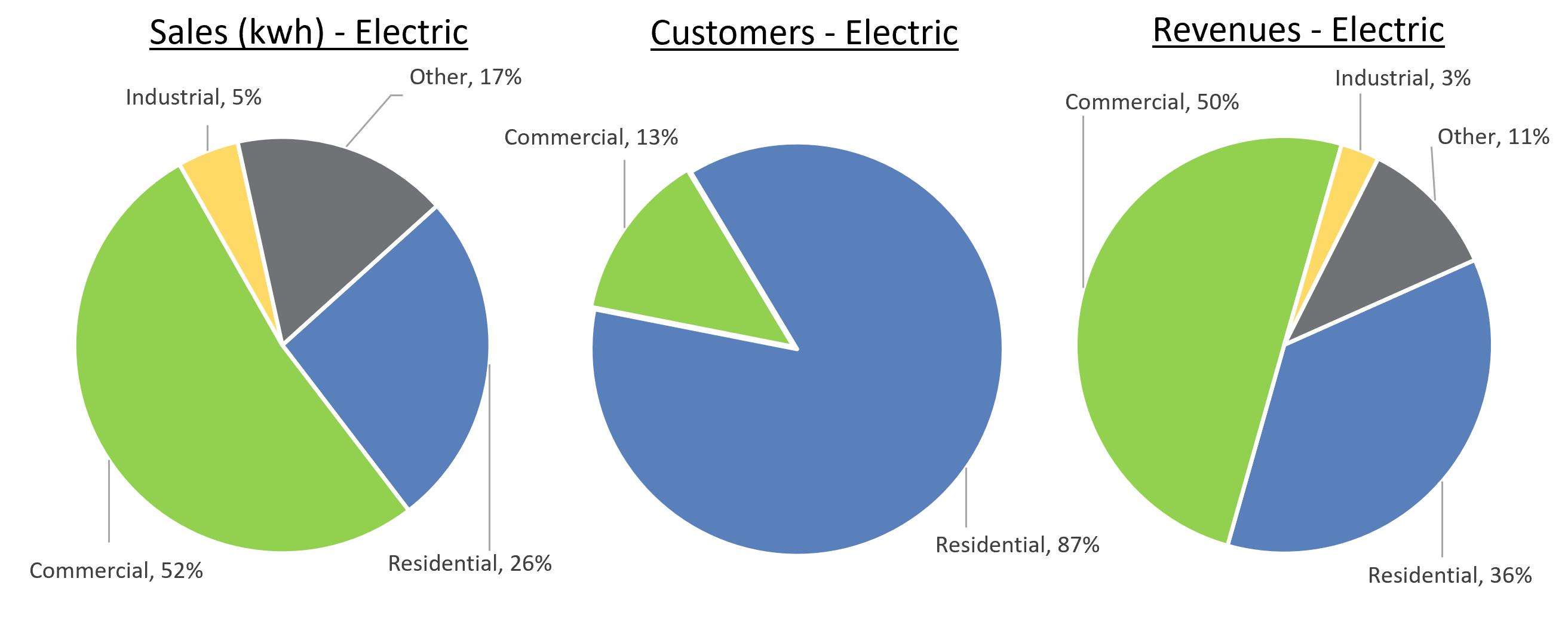

Renewable generation - Our solar, wind, and battery storage projects, as described below, are a major step toward deep decarbonization and greater use of clean energy sources in pursuit of our net-zero carbon goal. Additionally, MGE seeks to reduce its use of fossil fuels and work to help customers with energy efficiency and electrification, including the electrification of transportation.

Since 2015, MGE has announced several new joint and wholly-owned utility-scale wind and solar projects, which are expected to increase MGE's owned renewable capacity by more than nine times when completed by 2024. Following is a timeline of when these renewable energy projects have been completed or expected to be completed and MGE's share of capacity.

MGE is working to achieve a more sustainable energy future by investing in cost-effective renewable generation and innovative new technologies and services for customers. MGE has emphasized this innovation by developing customer programs to address climate change and encourage our customers to use clean energy. Our Renewable Energy Rider and Shared Solar programs reduce MGE's carbon emissions while providing customers the ability to purchase renewable energy to meet their energy needs, and we have been working on many fronts in the community to further the electrification of transportation.

Renewable Energy Rider (RER) – Under this program, MGE partners with large energy users on customized renewable energy solutions. MGE owns the generation assets and RER customers are billed a contractual renewable resource rate for all costs associated with the construction and ongoing operations of the renewable generation facility. This contractual rate is approved by the PSCW and subject to terms and conditions specified in the RER rate schedule. The program entitles RER customers to the contractually-specified energy output of the renewable energy resource. MGE will continue to recover the distribution system costs related to the energy consumed by these customers. Dane County Solar serves the Dane County municipal government. Morey Field RER serves the City of Middleton and Middleton-Cross Plains School District. The O'Brien Solar Fields primarily serve

10

governmental entities such as UW-Madison, Wisconsin Department of Administration, and the City of Fitchburg. Hermsdorf will serve the City of Madison and Madison Metropolitan School District.

Shared Solar Program – This program provides an opportunity for eligible customers to add locally-generated solar to their energy mix without having to install solar panels on their premises. The first solar array associated with this program, owned by MGE, became operational in 2017 and was fully subscribed for its capacity value of 500 KW. MGE expanded the program by completing construction of a second solar facility (Morey Field), which added 3.5 MW of capacity to the program in 2020.

Electrifying transportation - The electrification of transportation is a key strategy for reducing carbon emissions. MGE has a network of 45 charging stations, powered by renewable energy, serving the growing number of electric vehicles (EV) in our service area. The new EV fast charging hub began serving drivers in late 2021 and features some of the most powerful EV chargers in the Midwest. Charge@Home, MGE's home EV charging program, makes it easy for EV drivers to charge efficiently and conveniently. We have continued to add EVs to our fleet and are targeting 100% all-electric or plug-in hybrid light-duty vehicles by 2030. Additionally, we are working with the City of Madison to further the electrification of its vehicles and recently assisted with the addition of three all-electric buses to Madison's public transportation fleet.

Natural gas as a fuel source - In January 2022, MGE, along with joint applicants, filed an application with the PSCW requesting approval for a sale and purchase of ownership interests in the West Riverside Energy Center, a highly efficient, state-of-the-art natural gas-fired plant in Beloit, Wisconsin. If approved, MGE's share of West Riverside will be 25 MW. The closing and actual transfer of ownership is expected to occur in March 2023. MGE also retains the option to purchase an additional 25 MW of capacity from West Riverside until May 2025. MGE currently expects to exercise this option in a future period. Natural gas has much lower carbon emission rates compared to coal-fired generation. The investment in the West Riverside plant will help MGE to retire Columbia ahead of schedule in order to dramatically increase the amount of clean energy in our generating mix.

Generation sources

MGE receives electric generation supply from coal-fired, gas-fired, and renewable energy sources. These sources include owned facilities as well as facilities leased from affiliates and accounted for under our nonregulated energy operations. See Item 2. Properties for more information regarding these generation sources, including location, capacity, ownership or lease arrangement, and fuel source. See "Nonregulated Energy Operations" below for more information regarding generating capacity leased to MGE by nonregulated subsidiaries.

Purchased power

MGE enters into short- and long-term purchase power commitments with third parties to meet a portion of its anticipated electric energy supply needs. The following table identifies purchase power commitments as of December 31, 2021, with unaffiliated parties for the next five years.

(Megawatts) |

|

2022 |

|

|

2023 |

|

|

2024 |

|

|

2025 |

|

|

2026 |

|

|||||

Purchase power commitments |

|

|

33 |

|

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

Gas Utility Operations

MGE transports and distributes natural gas in a service area covering 1,684 square miles in seven south-central Wisconsin counties. The service area includes the city of Madison, Wisconsin and surrounding areas.

11

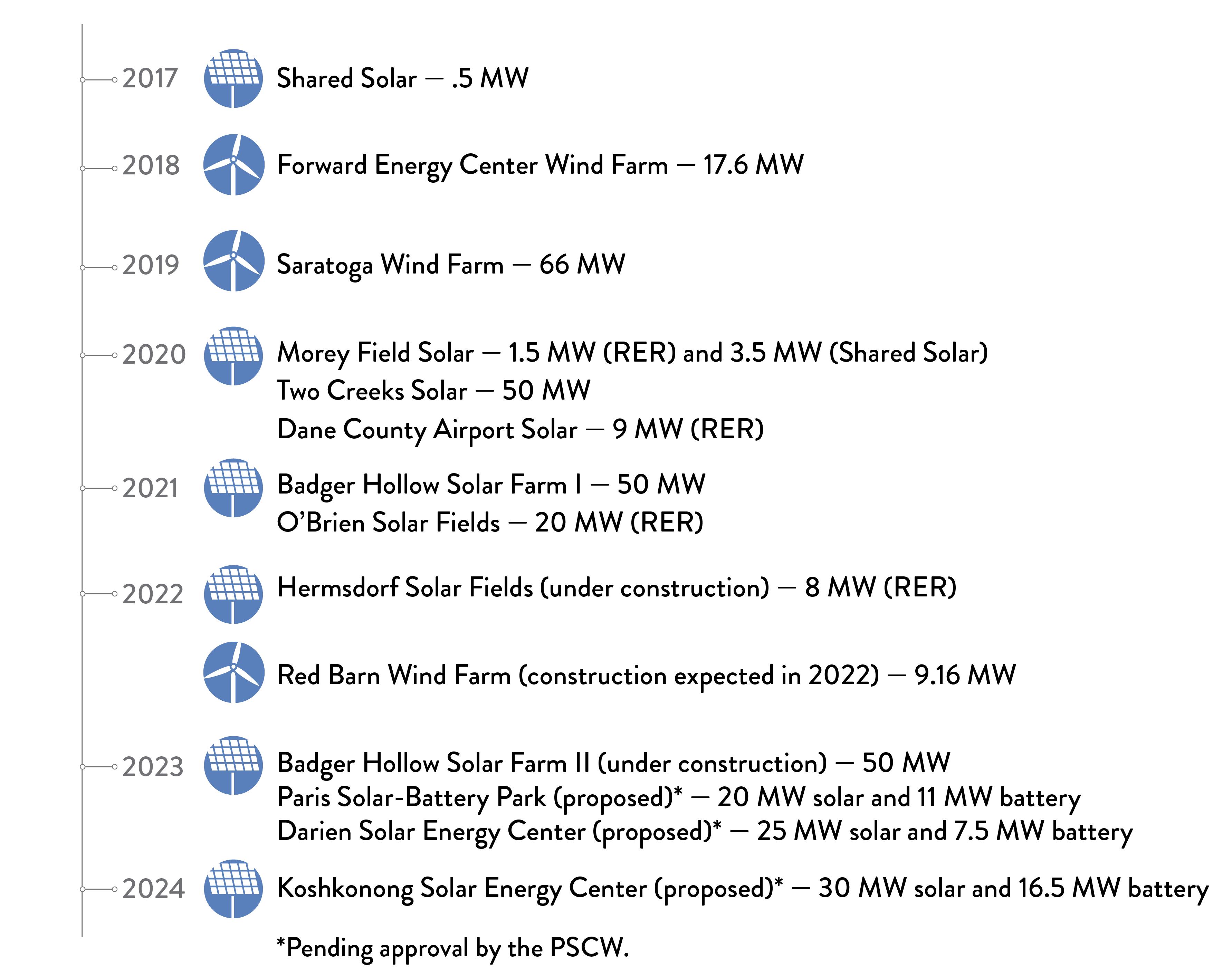

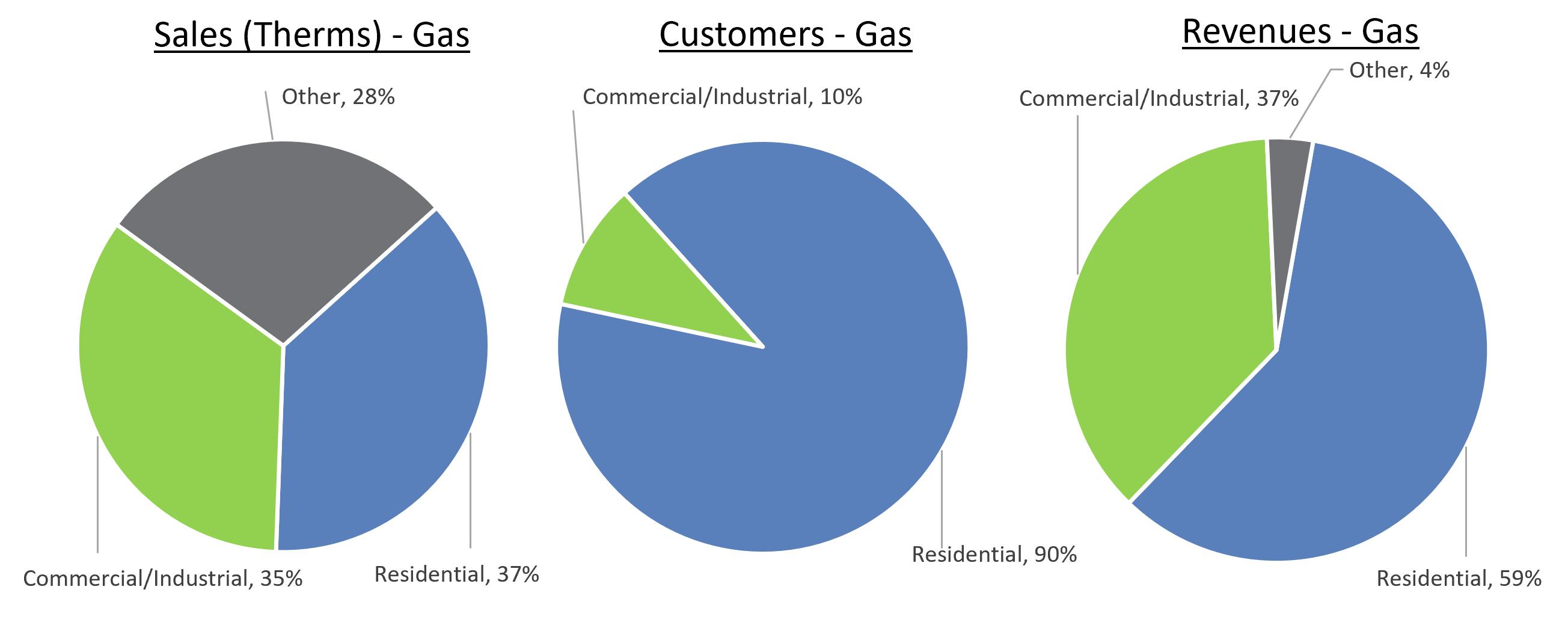

As of December 31, 2021, MGE supplied natural gas service to approximately 169,000 customers in the cities of Elroy, Fitchburg, Lodi, Madison, Middleton, Monona, Prairie du Chien, Verona, and Viroqua; 27 villages; and all or parts of 53 townships. Gas sales, customers, and revenues for 2021 were comprised of the following:

Gas operations accounted for approximately 30.6%, 26.8%, and 28.1% of MGE's total 2021, 2020, and 2019 regulated revenues, respectively.

MGE can curtail gas deliveries to interruptible customers. These are customers who agree to reduce their load in the case of an emergency interruption. Approximately 3% of retail gas deliveries in 2021, 2020 and 2019 were to interruptible customers.

Gas supply

MGE has physical interconnections with ANR Pipeline Company (ANR) and Northern Natural Gas Company (NNG). MGE's primary service territory, which includes Madison and the surrounding area, receives deliveries at one NNG and four ANR gate stations. MGE's outlying territory receives deliveries at NNG gate stations located in Elroy, Prairie du Chien, Viroqua, and Crawford County. Interconnections with two major pipelines provide competition in interstate pipeline service and a more reliable and economical gas supply mix, which includes gas from Canada and the mid-continent and Gulf Coast regions of the United States.

During the winter months, when customer demand is high, MGE is primarily concerned with meeting its obligation to customers. MGE meets customer demand by using firm supplies under contracts finalized before the heating season, supplies in storage (injected during the summer), and other firm supplies purchased during the winter period.

By contract, a total of 5,918,397 Dth of gas can be injected into ANR's storage fields in Michigan from April 1 through October 31. These gas supplies are then available for withdrawal during the subsequent heating season, November 1 through March 31. Using storage allows MGE to buy gas supplies during the summer season, when prices are normally lower, and withdraw these supplies during the winter season, when prices are typically higher. Storage also gives MGE more flexibility in meeting daily load fluctuations.

MGE's contracts for firm transportation service of gas include winter maximum daily quantities of:

Nonregulated Energy Operations

MGE Energy, through our subsidiaries, has developed generation sources that assist MGE in meeting the electricity needs of our customers. These sources consist of the Elm Road Units and the WCCF, which are owned by

12

subsidiaries of MGE Energy and leased to MGE. See Item 2. Properties for a description of these facilities, their joint owners, and the related lease arrangements.

Transmission Investments

ATC owns and operates electric transmission facilities primarily in Wisconsin. MGE received an interest in ATC when it, like other Wisconsin electric utilities, contributed its electric transmission facilities to ATC as required by Wisconsin law. That interest is presently held by MGE Transco, a wholly-owned subsidiary of MGE Energy. As of December 31, 2021, MGE Transco held a 3.6% ownership interest in ATC.

In 2016, ATC Holdco was formed by several of the members of ATC, including MGE Energy, to facilitate electric transmission development and investments outside of Wisconsin, which typically have long development and investment lead times before becoming operational. ATC Holdco's future transmission development activities have been suspended for the near term. MGE Energy's ownership interest in ATC Holdco is held by MGEE Transco, a wholly-owned subsidiary. As of December 31, 2021, MGEE Transco held a 4.4% ownership interest in ATC Holdco.

Environmental

MGE Energy and MGE are subject to frequently changing local, state, and federal regulations concerning air quality, water quality, land use, threatened and endangered species, hazardous materials handling, and solid waste disposal. These regulations affect the manner in which we conduct our operations, the costs of those operations, as well as capital and operating expenditures. Regulatory initiatives, proposed rules, and court challenges to adopted rules, have the potential to have a material effect on our capital expenditures and operating costs. In addition to the regulations discussed below, MGE continues to track state and federal initiatives such as potential state and federal regulations governing surface water and/or groundwater containing per- and polyfluoroalkyl substances, potential changes to regulations governing polychlorinated biphenyl (PCB), potential changes to air and water standards, and potential climate change legislation.

In February 2021, MGE and the other co-owners of Columbia announced plans to retire that facility. The co-owners intend to retire Unit 1 by the end of 2023 and Unit 2 by the end of 2024. Final timing and retirement dates are subject to change depending on operational, regulatory, and other factors. Effects of environmental compliance discussed below will depend upon the final approved retirement dates and compliance requirement dates.

Federal and State Environmental Compliance During the Current Pandemic

MGE was identified as an essential business under the State of Wisconsin's Safer at Home directive. It has been operating with full staff and has continued to prioritize its compliance with all applicable environmental regulations. MGE continues to follow local orders, as well as state Department of Health and Center for Disease Control guidance to operate in a manner to address potential spread of COVID-19 in order for the essential utility services to operate without interruptions. MGE has developed contingencies for remaining in compliance during the pandemic. However, management cannot predict with certainty whether COVID-19 will disrupt these compliance activities. MGE expects to continue to build contingencies into compliance operations and communicate with regulators as needed during this unprecedented time.

Water Quality

EPA's Effluent Limitations Guidelines and Standards for Steam Electric Power Generating Point Source Category

The EPA's promulgated water Effluent Limitations Guidelines (ELG) and standards for steam electric power plants focus on the reduction of metals and other pollutants in wastewater from new and existing power plants. MGE's Columbia plant and Elm Road Units are subject to this rule.

See Footnote 16.a. of the Notes to the Consolidated Financial Statements in this Report for further discussion of compliance plans for Columbia and the Elm Road Units. Management believes that any compliance costs will be recovered in future rates based on previous treatment of environmental compliance projects.

13

EPA Cooling Water Intake Rules (Section 316(b))

Section 316(b) of the Clean Water Act requires that the cooling water intake structures at electric power plants meet best available technology (BTA) standards to reduce mortality from entrainment (drawing aquatic life into a plant's cooling system) and impingement (trapping aquatic life on screens). The EPA finalized its Section 316(b) rule for existing facilities in 2014. Section 316(b) requirements are implemented in Wisconsin through modifications to plants' WPDES permits, which govern plant wastewater discharges.

WCCF, Blount, and Columbia are subject to this rule. WCCF employs a system that meets the Section 316(b) rule. Blount's WPDES permit assumes that the plant meets BTA for the duration of the permit, which expires in 2023. Before the next permit renewal, MGE is required to complete an entrainment study and recommend a BTA along with other technologies considered. MGE completed the entrainment study in 2021 and submitted the results to the WDNR. The WDNR will make the final BTA determination and include any BTA requirements in Blount's next permit renewal, which is expected to be completed by the end of 2022 and effective in 2023. Management believes that the BTA determination at Blount will not be material for MGE.

Section 316(b) applies to river intakes at the Columbia plant. Columbia's operator received a permit in 2019 requiring studies of intake structures to be submitted to the WDNR by November 2023 to help determine BTA. BTA improvements may not be required given that Columbia is scheduled to retire both units by the end of 2024. MGE will continue to work with Columbia's operator to evaluate all regulatory requirements applicable to the planned retirements.

Management believes that the Section 316(b) rule will not have a material effect on its existing plants and that any compliance costs will be recovered in future rates based on previous treatment of environmental compliance projects.

Air Quality

Air quality regulations promulgated by the EPA and WDNR in accordance with the Federal Clean Air Act and the Clean Air Act Amendments of 1990 impose restrictions on emission of particulates, sulfur dioxide (SO2), nitrogen oxides (NOx), hazardous air pollutants and other pollutants, and require permits for operation of emission sources. These permits must be renewed periodically. Various newly enacted and/or proposed federal and state initiatives may result in additional operating and capital expenditure costs for fossil-fueled electric generating units.

Ozone NAAQS

In May 2021, the EPA published a final rule that expands several nonattainment areas in Wisconsin to include all of Milwaukee County wherein MGE's Elm Road Units are located. The WDNR must develop a State Implementation Plan (SIP) for the area, which will likely result in more stringent requirements for both new development and modification or expansion of existing plants in the area. MGE will monitor the WDNR's SIP development and the extent to which the requirements will impact the Elm Road Units. At this time, MGE does not expect that the 2015 Ozone NAAQS will have a material effect on its existing plants based on final designations.

EPA's Cross-State Air Pollution Rule (CSAPR): Proposed Ozone Season Update based on 2008 Ozone NAAQS

The EPA's CSAPR and its progeny are a suite of interstate air pollution transport rules designed to reduce ozone and fine particulate (PM2.5) air levels in areas that the EPA has determined as being significantly impacted by pollution from upwind states.

MGE has met its current obligations through a combination of reduced emissions through pollution control (e.g. SCR installation at Columbia), as well as owned, received, and purchased allowances. MGE expects to meet ongoing CSAPR obligations for the foreseeable future.

Clean Air Visibility Rule (CAVR)

Columbia is subject to the best available retrofit technology (BART) regulations, a subsection of the EPA's CAVR, which may require pollution control retrofits. Columbia's existing pollution control upgrades, and the EPA's stance that compliance with the CSAPR equals compliance with BART, should mean that Columbia will not need to do additional work to meet BART requirements. Wisconsin's 2021 SIP argues that Wisconsin will meet its current regional haze goals based on expected emissions reductions, which includes Columbia unit retirements. Given that the Wisconsin SIP recognizes the Columbia unit retirements as part of its emission reduction plan, MGE does not

14

anticipate further obligations with this rule at Columbia. MGE will continue to monitor legal developments and any future updates to this rule.

Global Climate Change

MGE is a producer of greenhouse gas (GHG) emissions, primarily from the fossil fuel generating facilities it uses to meet customers' energy needs, as well as from its natural gas pipeline system and fleet vehicles. Climate change and the regulatory response to it could significantly affect our operations in a number of ways, including increased operating costs and capital expenditures, restrictions on energy supply options, operational limits on our fossil fuel fired plants, permitting difficulties, and emission limits. MGE management would expect to seek and receive rate recovery of such compliance costs, if and when required. MGE continues to monitor proposed climate change legislation and regulation.

MGE has taken steps to address GHG emissions through voluntary actions. In 2005, MGE implemented its Energy 2015 Plan, which committed to ensuring a balanced, economic energy supply with reduced environmental emissions. The Plan emphasized increased renewable energy, energy efficiency, and new cleaner generation – three strategies that reduced GHG emissions. Under the Plan and other actions, our CO2 emissions declined from 2005 to 2015 by approximately 20% even though total system delivered energy increased. In 2015, MGE announced its Energy 2030 framework that continues steps to reduce CO2 emissions. Subject to regulatory approvals and other conditions, MGE aims to increase renewable energy to 25% of retail electric sales by 2025 and to 30% by 2030. Under our Energy 2030 framework prior to the announcement of the Columbia retirement, our plan was to reduce CO2 emissions by 40% from 2005 levels by 2030. In January 2022, MGE announced a new target of 80% carbon reduction, significantly exceeding the original 2030 goal. Beyond 2030, we are targeting net-zero carbon electricity by 2050, including our commitment to work with our co-owners at our Elm Road Units to reduce coal use by 2030 and eliminate coal use by 2035.

Federal Action on Climate Change

President Biden's actions on climate change, including multiple executive orders and the recommitment of the U.S. to the Paris Agreement under the United Nations Framework Convention on Climate Change (the Paris Agreement), indicate that he intends to make climate considerations a broad focus of his administration.

The executive orders include an order establishing climate change as an essential element of domestic and international governmental policy. The order indicates that the U.S. will develop its emissions reduction targets under the Paris Agreement, instructs executive staff and federal departments and agencies to take actions to combat climate change using a government-wide approach, and creates several interagency working groups tasked with providing recommendations to meet the order's goals. A second executive order directs executive departments and agencies to review all federal actions taken under the previous presidential administration to determine whether they meet the objectives of protecting the environment, addressing climate change, and addressing public health. The order further instructs those departments and agencies to take applicable action, including suspending, revising or rescinding rules to correct any federal action under the previous administration that does not meet the national objectives set forth in the order. MGE is following the development of recommendations and plans developed by agencies as a result of these orders, as well as other executive actions taken by the new administration, to determine their applicability to MGE's decarbonization plans and to evaluate any potential impact to our operations.

In December 2021, President Biden signed an executive order that sets goals for the federal government agencies and operations to have, among other things, 100% carbon-free electricity by 2030, acquisitions of vehicles to be 100% zero-emissions light-duty vehicles by 2027, and all vehicles by 2035, and net-zero emissions from federal operations by 2050. Efforts at the federal level are expected to spur the carbon-neutral economy in the private sector.

Legislative Actions

MGE is monitoring current legislative actions on climate change to determine their level of significance to MGE's decarbonization plans.

15

State and Regional Action on Climate Change

Executive Order Relating to Clean Energy Wisconsin

In August 2019, Wisconsin Governor Tony Evers signed an executive order to establish the Office of Sustainability and Clean Energy (OSCE). The order tasks the OSCE with, among other things, ensuring that the actions of the State of Wisconsin are aligned with the goals and recommendations of the Paris Agreement, verifying that electricity consumed by the State of Wisconsin is 100% carbon-free by 2050, and developing a comprehensive multi-sector clean energy plan for the state. The OSCE has put forth preliminary recommendations and is in the process of creating the statewide plan. MGE is engaged in this process and is participating on a Stakeholder Advisory Team in a voluntary capacity. MGE will be evaluating this plan for its applicability to MGE's decarbonization plans and to evaluate potential impact to our operations.

EPA's Greenhouse Gas Reduction Guidelines under the Clean Air Act 111(d) Rule

In January 2021, the D.C. Circuit vacated and remanded to the EPA the Affordable Clean Energy Rule (ACE Rule) and repealed the predecessor Clean Power Plan Rule (CPP Rule), both of which regulated greenhouse gas emissions from existing electric generation units pursuant to Section 111(d) of the Clean Air Act. MGE is evaluating this D.C. Circuit decision for what impacts it may have on MGE's operations. In October 2021, the EPA formally announced its intention to introduce a proposed GHG rule in July 2022. The EPA has described the pending proposed rule as guidelines for states to regulate GHGs under Section 111(d). MGE will continue to monitor and evaluate the rule development.

Solid Waste

EPA's Coal Combustion Residuals Rule

The EPA's 2015 Coal Combustion Residuals Rule (CCR), which regulates coal ash from burning coal for the purpose of generating electricity as a solid waste and defines what ash use activities would be considered generally exempt beneficial reuse of coal ash. The CCR rule also regulates landfills, ash ponds, and other surface impoundments used for coal combustion residuals by regulating their design, location, monitoring, and operation.

In July 2018, the EPA published a final rule that included amendments to the CCR. The amendments include the allowance of alternative performance standards for landfills and surface impoundments, revised risk-based groundwater protection standards, and an extension of the deadline by which certain facilities must cease the placement of waste in CCR units. In August 2018, the D.C. Circuit vacated parts of the 2015 CCR for not being sufficiently protective of the environment. In August 2020, the EPA revised the CCR rule to require owners or operators of coal-fired power plants to stop transporting CCR and non-CCR wastewater to unlined surface impoundments. In addition, regulated entities must initiate impoundment closure as soon as feasible and in no event later than April 2021, unless the EPA grants an extension. Columbia requested an extension to initiate closure by October 2022. The EPA has not formally approved the extension. The Columbia owners anticipate that the EPA will approve the extension request. However, we will not know the outcome of the extension request with any certainty until the EPA completes its rules review.

Review of the Elm Road Units has indicated that the costs to comply with this rule are not expected to be significant. Columbia's operator has completed a review of its system and has developed a compliance plan. See Footnote 16.a. of the Notes to the Consolidated Financial Statements in this Report for further discussion.

Renewable Energy Standards

Wisconsin law establishes a minimum amount of energy MGE must supply from renewable sources. MGE currently exceeds the applicable minimum requirement of approximately 8%. The costs to comply with this requirement are being recovered in rates.

Human Capital

The energy industry is ever-changing. MGE Energy and MGE believe it is important to continue to engage our human capital resources as our industry evolves. We are committed to sustainable workforce practices such as career development and training. We offer all employees the opportunity to learn and grow—whether the goal is to increase job proficiency, improve decision-making skills, or prepare for new roles and responsibilities. We work

16

to provide our employees with the tools they need to be successful in their careers. This strategy is essential given our aging workforce and the recent retirement of key employees.

We value equity, diversity, and inclusion. We promote an inclusive, respectful work environment where individuals and groups can achieve their full potential. All employees have equitable access to employment and development opportunities. Everyone is responsible for helping to meet the objectives of our diversity and inclusion policy as well as supporting the principles of equal opportunity and affirmative action. We believe that our diversity makes us stronger.

Our journey to safety excellence is guided by our Safety Steering Team. The team meets regularly to examine safety topics and to identify and to prioritize continuous improvement opportunities.

The COVID-19 pandemic drove several changes in 2020 and continued throughout 2021. These changes range from equipping our field workers with personal protective equipment to offering support to office employees working from home. We continue to address challenges related to the pandemic as they arrive and will continue to meet the critical needs of our community. The safety of our employees and customers is always our top priority.

As of December 31, 2021, MGE had 706 employees, 323 of which are covered by collective bargaining agreements as described below:

Union |

|

Number of Employees Represented |

|

Expiration of Collective Bargaining Agreement |

Local Union 2304 of the International Brotherhood of Electrical Workers |

|

229 |

|

April 30, 2023 |

Local Union No. 39 of the Office and Professional Employees International Union |

|

90 |

|

May 31, 2023 |

Local Union No. 2006, Unit 6 of the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial, and Service Workers International Union |

|

4 |

|

October 31, 2023 |

Financial Information About Segments

See Footnote 22 of the Notes to the Consolidated Financial Statements in this Report for financial information relating to MGE Energy's and MGE's business segments.

17

Information About our Executive Officers

As of December 31, 2021, the executive officers of the registrants were as follows:

Executive |

|

Title |

|

Effective |

|

Service |

Jeffrey M. Keebler(a) |

|

Chairman of the Board, President, and Chief Executive Officer |

|

10/01/2018 |

|

10 |

Age: 50 |

|

President and Chief Executive Officer |

|

03/01/2017 |

|

|

|

|

Senior Vice President – Energy Supply and Planning |

|

07/23/2015 |

|

|

|

|

|

|

|

|

|

Jared J. Bushek(a) |

|

Vice President – Finance, Chief Information Officer and Treasurer |

|

09/01/2020 |

|

6 |

Age: 41 |

|

Assistant Vice President – Chief Information Officer |

|

07/23/2015 |

|

|

|

|

|

|

|

|

|

Lynn K. Hobbie(b) |

|

Executive Vice President – Marketing and Communications |

|

03/01/2017 |

|

27 |

Age: 63 |

|

Senior Vice President – Marketing and Communications |

|

02/01/2000 |

|

|

|

|

|

|

|

|

|

Tamara J. Johnson(a) |

|

Vice President – Accounting and Controller |

|

09/01/2020 |

|

6 |

Age: 57 |

|

Assistant Vice President – Controller |

|

07/23/2015 |

|

|

|

|

|

|

|

|

|

Donald D. Peterson(c) |

|

Vice President - Technology |

|

03/01/2019 |

|

6 |

Age: 62 |

|

Assistant Vice President - Strategic Products and Services |

|

07/23/2015 |

|

|

|

|

|

|

|

|

|

Cari Anne Renlund(a) |

|

Vice President, General Counsel and Secretary |

|

09/01/2020 |

|

6 |

Age: 48 |

|

Vice President and General Counsel |

|

11/02/2015 |

|

|

Note: Ages, years of service, and positions as of December 31, 2021.

18

Item 1A. Risk Factors.

MGE Energy and our subsidiaries, including MGE, operate in a regulated market environment that involves significant risks, many of which are beyond our control. The following risk factors may adversely affect our results of operations, cash flows and financial position and market price for our publicly traded securities. While we believe we have identified and discussed below the key risk factors affecting our business, additional unknown risks and uncertainties may adversely affect our performance or financial condition in the future.

Pandemic virus or diseases, including COVID-19 and its variants, could have a material adverse effect on our business, financial condition and liquidity.

The continued presence of the Coronavirus Disease 2019 and its variants (COVID-19) could adversely affect our customers, our business, our financial condition and our liquidity. Possible effects include:

We cannot reasonably estimate with any degree of certainty the actual impact COVID-19 may have on our results of operations, financial position, and liquidity. The extent of those impacts will depend on the persistency of COVID-19, the efficacy of vaccines and other preventative measures, and consumer behavior.

Moreover, the effects of the COVID-19 pandemic may heighten many of the other risks described in this section including interest rate changes, rating agency actions, governmental actions and market volatility.

Regulatory Risk

We are subject to extensive government regulation in our business, which affects our costs and responsiveness to changing events and circumstances.

Our business is subject to regulation at the State and Federal levels. We are subject to regulation as a holding company by the PSCW. The PSCW regulates MGE's rates; terms and conditions of service; various business practices and transactions; financing; the closure of generating facilities and related cost recovery; and

19

transactions between it and its affiliates, including MGE Energy. MGE is also subject to regulation by the FERC, which regulates certain aspects of its business. ATC, in which we have an investment, is subject to regulation by FERC as to, among other things, rates. The regulations adopted by the State and Federal agencies affect how we do business, our ability to undertake specified actions since pre-approval or authorization may be required for projects, the costs of operations, and the rates charged to recover those costs. Our ability to attract capital also depends, in part, upon our ability to recover our costs and obtain a fair return for shareholders.

Our utility revenues are subject to regulatory proceedings, which can affect our ability to recover, and the timing of recovery of, costs that we incur in our operations.

Our utility customer rates have a material impact on our financial condition, results of operations, and liquidity. Our ability to obtain adjustments to those rates depends upon timely regulatory action under applicable statues and regulations. Rate regulation is based on providing an opportunity to recover costs that have been reasonably incurred and the ability to earn a reasonable rate of return on invested capital. However, we have no assurance that our regulators will consider all of our costs to have been reasonably incurred. In addition, our rate proceedings may not always result in rates that fully recover our costs or provide a reasonable return on equity. Certain costs and revenues are deferred as regulatory assets and liabilities for future recovery or refund to customers, as authorized by our regulators. If recovery of regulatory assets is not approved or is no longer deemed probable, these costs would be recognized as a current period expense and could materially and adversely impact our operations and financial performance in that period.

We could be subject to higher costs and potential penalties resulting from mandatory reliability standards.

MGE must adhere in its electric distribution system to mandatory reliability standards established by NERC. These standards cover areas such as critical infrastructure protection, emergency preparedness, facility design, and transmission operations, among others. The critical infrastructure protection standards focus on physical and access security of cyber assets, as well as incident response and recovery planning. Compliance with these standards affects operating costs and any noncompliance can result in sanctions, including monetary penalties.

We are subject to changing environmental laws and regulations that may affect our costs and business plans.

We are subject to environmental laws and regulations that affect the manner in which we conduct business, including capital expenditures, operating costs, and potential liabilities. The current presidential administration is expected to undertake an active effort on climate change-related matters, including restrictions on greenhouse gas emissions, such as carbon. While it is difficult to know the extent of possible legislation or regulatory activity, it is expected there will be an increase in the number and scope of environmental laws and regulations aimed at fossil-fueled generation and the transportation of natural gas. These possible changes, as well as evolving consumer sentiment, have affected and may continue to affect our business plans, make them more costly, or expose us to liabilities for past, present, or future operations.

Numerous environmental laws and regulations govern many aspects of our present and future operations. These include: air emissions limits and reporting; ambient air quality standards; water quality; water intake and discharges; wetlands; solid and hazardous waste; handling and disposal of hazardous substances; protection of endangered resources, such as threatened and endangered species, protection of cultural resources and archaeological sites; remediation and management of contaminated sites; and control of potential pollution from electric and gas construction sites. These evolving regulations affect us by:

20

We may be subject to future laws, regulations, or actions associated with public concern with fossil-fuel generation, greenhouse gases, and the effects of global climate change.

Our subsidiaries operate or co-own electric power plants that burn fossil fuels, deliver natural gas, and deliver electricity to customers. These business activities are subject to evolving public concern regarding greenhouse gases (GHG), legislative and regulatory action, and possible litigation in response to that public concern. The primary greenhouse gas associated with our subsidiaries' combustion of fossil fuels, and the largest emission in our system overall, is carbon dioxide (CO2).

Our subsidiaries have incurred and are expected to continue to incur costs from more stringent regulation of GHG from power plants, natural gas delivery, greenhouse gases used in power distribution, and efficiencies lost during power distribution. While it is difficult to know the extent of possible legislation or regulatory activity, the federal government is likely to consider and pass some form of greenhouse gas legislation or regulations. In addition, litigation by environmental nongovernment organizations targeting GHG emissions from the electric power industry is also likely if the federal government fails to act on greenhouse gas initiatives.

Climate change could affect us in several other ways:

These matters represent uncertainties in the operation and management of our business.

We face risk for the recovery of fuel and purchased power costs.

MGE has price risk exposure with respect to the price of natural gas, electricity, coal, emission credits, and oil. MGE burns natural gas in several of its peak electric generation facilities. In many cases, the cost of purchased power is tied to the cost of natural gas. In the event of an interruption in energy supply, whether due to equipment problems, transmission constraints, or otherwise, we may incur additional costs to obtain alternative sources of energy supply, in order to meet our contractual or regulatory obligations to our customers. Under the electric fuel rules, MGE would defer electric fuel-related costs that fall outside a symmetrical cost tolerance band. Any over- or under-recovery of the actual costs in a year is determined in the following year and is then reflected in future billings to electric retail customers. Under the electric fuel rules, MGE would defer the benefit of lower costs, if its actual fuel costs fall outside the lower end of the range, and is required to defer costs, less any excess revenues, if its actual fuel costs exceed the upper end of the range. Excess revenues are defined as revenues in the year in question that provide MGE with a greater return on common equity than authorized by the PSCW in MGE's latest rate order. MGE assumes the risks and benefits of variances that are within the cost tolerance band.

Changes in federal income tax policy may adversely affect our financial condition, results of operations, and cash flows, as well as our subsidiaries' credit ratings.

We currently own and operate renewable energy generating facilities. These facilities generate production tax credits and investment tax credits that we use to reduce our federal tax obligations. The amount of tax credits we

21

earn depends on multiple factors, including facility generation, the cost of qualifying property, and the applicable tax credit rate. The disallowance of these tax credits in whole or in part as a result of changes in tax law or regulation could adversely impact our earnings and cash flows.

If corporate tax rates or policies are changed with future federal or state legislation, we may be required to take material charges against earnings.

There is still uncertainty as to when or how credit rating agencies, capital markets, the FERC, or state public utility commissions will treat impacts of any new tax regulation. These impacts could subject us or any of our subsidiaries to further credit rating downgrades. In addition, certain financial metrics used by credit rating agencies, such as our funds from operations-to-debt percentage, could be negatively impacted by future rulings.

We may not be able to use all tax credits for which we are eligible.

We have historically reduced our consolidated federal and state income tax liability with the use of various tax credits under the applicable tax codes. We may not be able to fully use tax credits if our future federal and state taxable income and related income tax liability is insufficient to permit their use. In addition, any future disallowance of some or all of those tax credits as a result of legislation or an adverse determination by one of the applicable taxing jurisdictions could materially affect our tax obligations and financial results.

Operating Risk

We are affected by weather, which affects customer demand and can affect the operation of our facilities.

The demand for electricity and gas is affected by weather. Very warm and very cold temperatures, especially for prolonged periods, can dramatically increase the demand for electricity and gas for cooling and heating, respectively, as opposed to the softening effect of more moderate temperatures. Our electric revenues are sensitive to the summer cooling season and, to a lesser extent, the winter heating season. Similarly, very cold temperatures can dramatically increase the demand for gas for heating. A significant portion of our gas system demand is driven by heating. Extreme summer conditions or storms may stress electric systems, resulting in increased maintenance costs and limiting the ability to meet peak customer demand.

We could be adversely affected by changes in the development, and utilization by our customers, of power generation, storage, and use technologies.

Our revenues and the timing of the recovery of our costs could be adversely affected by improvements in power generation, storage, and use technology.

Advancements in power generation technology, including commercial and residential solar generation installations and commercial micro turbine installations, are improving the cost-effectiveness of customer self-supply of electricity. Improvements in energy storage technology, including batteries and fuel cells, could also better position customers to meet their around-the-clock electricity requirements. Improvements in the energy efficiency of lighting, appliances, and equipment will also affect energy consumption by customers. Such developments could reduce customer purchases of electricity but may not necessarily reduce our investment and operating requirements due to our obligation to serve customers, including those self-supply customers whose equipment has failed for any reason to provide the power they need whether due to inadequate on-site resources, restricted operating hours, or equipment failure. In addition, since a portion of our costs are recovered through charges based upon the volume of power delivered, a reduction in electricity deliveries will affect the timing of our recovery of those costs and may require changes to our rate structures.

Changes in power generation, storage, and use technologies could have significant effects on customer behaviors and their energy consumption. Customers could engage in individual conservation efforts by voluntarily reducing their consumption of electricity through changes in energy use and through the use of more energy efficient lighting, appliances, and equipment. They could also change their consumption of electricity from us through the installation of alternative energy sources, such as rooftop solar panels and micro turbines for self-supply. Customer energy conservation could adversely affect our results of operations by reducing our revenues without necessarily changing our operating costs due to our obligation to serve.

22

We are affected by economic activity within our service area.

Higher levels of development and business activity generally increase the numbers of customers and their use of electricity and gas. Likewise, recessionary economic conditions generally have an adverse impact on our results of operations. Our business activities, including those of our subsidiaries, are concentrated in the State of Wisconsin. Changes in our local economy could negatively impact the financial condition of our customers, the growth opportunities available to us and our subsidiaries, and our results from operations.

The ability to obtain an adequate supply of coal could limit the ability to operate the co-owned coal-fired facilities from which we receive a significant portion of our electric supply.

The availability of coal and the means to transport coal could:

A significant portion of our electric generating capacity is dependent on coal. Demand for coal has been impacted by prevailing prices for natural gas and coal plant closures and may affect mine performance. Consequently, we are exposed to the risk that counterparties to these contracts will not be able to fulfill their obligations. Disruption in the delivery of fuel, including disruptions as a result of transportation delays, weather, labor relations, force majeure events, or environmental regulations affecting any of our fuel suppliers, could limit our ability to generate electricity at our facilities at the desired level. Should counterparties fail to perform, or other unplanned disruptions occur, we may be forced to fulfill the underlying obligation at higher prices. The plant operators may also be forced to reduce generation at our jointly-held coal units, which would cause us to replace this generation through additional power purchases from third parties. These factors may also affect the terms under which any of the existing coal supply or transportation agreements are renewed or replaced upon the expiration of their current terms.

Our ability to manage our purchased power costs is influenced by a number of uncontrollable factors.

We are exposed to additional purchased power costs to the extent that our power needs cannot be fully covered by the supplies available from our existing facilities and contractual arrangements. Those needs, and our costs, could be affected by:

An unexpected change in demand or the availability of generation or transmission facilities can expose us to increased costs of sourcing electricity in the short-term market where pricing may be more volatile.

The equipment and facilities in our operational system are subject to risks that may adversely affect our financial performance.

Weather conditions, accidents, and catastrophic events can result in damage or failures of equipment or facilities and disrupt or limit our ability to generate, transmit, transport, purchase, or distribute electricity and gas. Efforts to repair or replace equipment and facilities may take place over prolonged periods or may be unsuccessful. We

23

may also be unable to make the necessary improvements to our operational system, causing service interruptions. Furthermore, our facilities are interconnected with third-party transmission providers. Damage to or failures of these providers' equipment or facilities is out of our control but could lead to service interruptions. The resulting interruption of services would result in lost revenues and additional costs. We are also exposed to the risk of accidents or other incidents that could result in damage to or destruction of our facilities or damage to persons or property. Such issues could adversely affect revenues or increase costs to repair and maintain our systems.

We could be adversely affected by production disruptions at our wind generating facilities.

We own and operate wind generating facilities, which generate production tax credits used to reduce our federal tax obligations. Various operating and economic factors, including transmission constraints, unfavorable trends in pricing for wind energy, adverse weather conditions and the breakdown or failure of equipment, could significantly reduce the production tax credits generated by our wind farms, resulting in increased federal income tax expense. We could also be forced to replace lost wind generation capacity with additional power purchases from third parties, potentially leading to increased costs. These factors could have an adverse impact on our financial condition and results of operations, which could be material depending upon the cause of the disruption and its duration.

Our operations and confidential information are subject to the risk of cyber-attacks.

Cyber-attacks targeting our electronic control systems used in generation and electric and gas distribution, including denial of service and ransomware attacks, could result in a full or partial disruption of our operations. Any disruption of these control systems could result in a loss of service to customers and loss of revenue, as well as significant expense to repair system damage and remedy security breaches.

Our business includes the collection and retention of personally identifiable information of our customers, shareholders, and employees, who expect that we will adequately protect such information. In some cases, we outsource certain functions to vendors that could be targets of cyber-attacks. A significant theft, loss, or fraudulent use of personally identifiable information may cause our business reputation to be adversely impacted and could lead to potentially large costs to notify and protect the impacted persons and subject us to legal claims, fines, or penalties.

The safeguards we have may not always be effective due to the evolving nature of cyber-attacks. We cannot guarantee that such protections will be completely successful in the event of a cyber-attack. If the technology systems were to fail or be breached by a cyber-attack, and not be recovered in a timely fashion, we may be unable to fulfill critical business functions and confidential data could be compromised, any additional costs may not be recoverable in rates, or may exceed insurance limits, or may not be covered by insurance and could adversely impact our results of operations.

We rely on the performance of our information technology systems, the failure of which could have an adverse effect on our business and performance.

We operate in a highly engineered industry that requires the continued operation of sophisticated information technology systems and network infrastructure to manage our finances, to operate our control facilities, to provide electric and gas service to our customers, and to enable compliance with applicable regulatory requirements. Our computer-based systems are vulnerable to interruption, the introduction of viruses, malware, ransomware, security breaches, fire, power loss, system malfunction, network outages and other events that may be beyond our control. System interruptions or failures, whether isolated or more widespread, could impact our ability to provide service to our customers, which could have a material adverse effect on our operations and financial performance.

Catastrophic and unpredictable events could have a material adverse effect on our business.

A terrorist attack, war, natural disaster, pandemic virus or disease, or other catastrophic or unpredictable event could adversely affect our future revenues, expenses and operating results by: interrupting our normal business operations; causing employee absences or casualties, including loss of our key employees; interrupting or affecting

24

supplier operations; requiring substantial expenditures and expenses to repair, replace and restore normal business operations; and reducing investor confidence. Facilities for electric generation, transmission, and gas and electric distribution are potential targets of terrorist threats and activities. A terrorist act or catastrophic event at our facilities or the facilities of other companies to which we are interconnected could result in a disruption of our ability to generate, transmit, transport, purchase, or distribute electricity or natural gas. Such an event would have additional adverse effects, including environmental ramifications, increased security and insurance costs, as well as general economic volatility or uncertainty within our service territories. The inability to maintain operational continuity and any additional costs incurred for repairing our facilities or making alternative arrangements could materially and adversely affect our financial condition and results of operations.

We face risk in connection with the completion of significant capital projects.